Velo3D has licensed its metal additive manufacturing technologies to existing user SpaceX.

The non-exclusive Intellectual Property License and Support Services Agreement is worth up to 8 million USD for Velo3D.

Per the agreement, SpaceX has agreed to a 5 million USD license fee, with 2.5 million USD paid within three days of Velo3D initiating 'delivery of the technologies' and 2.5 million USD to be paid within three days of Velo3D 'completing delivery of the technologies.' The additional 3 million USD will cover the provision of ‘certain related engineering’ and other support services, with the amount being invoiced by the company in arrears based on ‘actual services provided to SpaceX.’

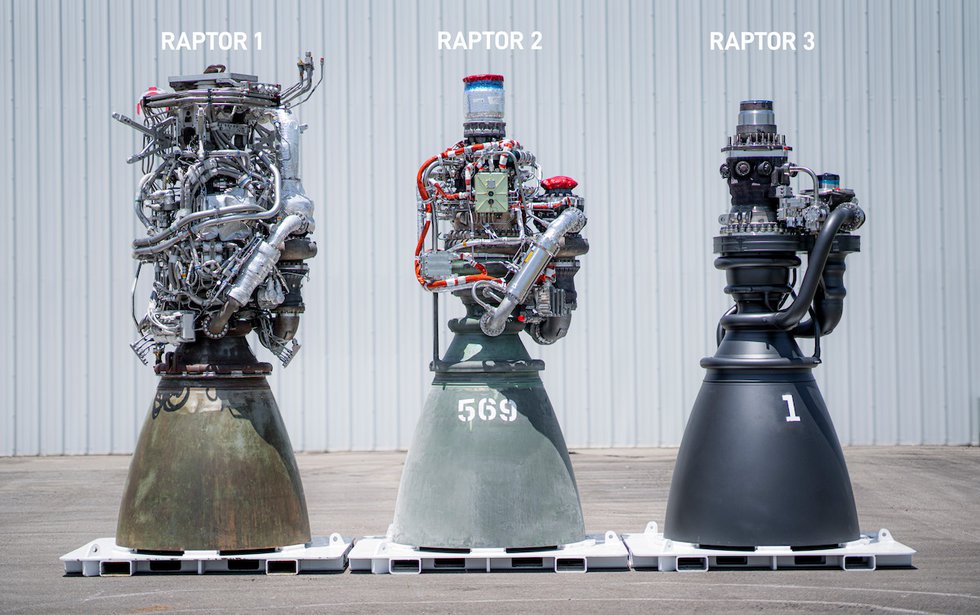

SpaceX is believed to have previously purchased and installed a series of Velo3D Sapphire Series metal additive manufacturing machines, with the aerospace giant leveraging the technology to produce engine components. Earlier this year, the company revealed a simplified Raptor engine, with an early investor in SpaceX suggesting additive manufacturing played a key role in its development.

According to a Form 8-K filed by Velo3D, the agreement is effective until terminated, and SpaceX will be entitled to a ‘complete duplicate of or complete access to’ all such intellectual property and embodiments of intellectual property subject to license in the event that Velo3D files for bankruptcy. This is in accordance with Section 365(n) of the Bankruptcy Code, which states: “all rights, licenses, and privileges granted to SpaceX under this Agreement will continue subject to the respective terms and conditions hereof, and will not be affected, even by Velo3D’s (or any trustee’s) rejection of this Agreement.”

Velo3D was recently delisted from the New York Stock Exchange after the company had fallen below the NYSE's continued listing standard, which requires listed companies to maintain an average global market capitalisation over a consecutive 30 trading day period of at least 15,000,000 USD. It has since commenced trading on the OTCQX Best Market under the VLDX ticker.