Entry-level 3D printers experienced a 22% surge in shipments in the first quarter of 2025, according to the latest figures by market intelligence firm CONTEXT.

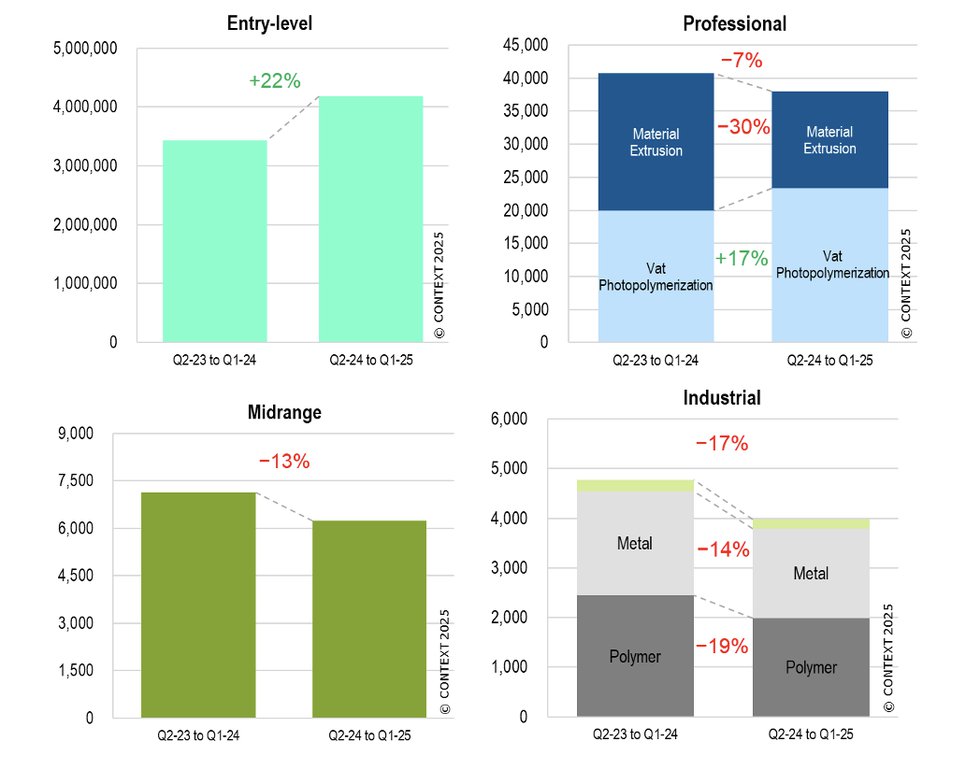

The increased sales of sub $2,500 machines, which saw over a million systems shipped, is thought to have been brought on by consumers and channel partners actively trying to get ahead of tariffs policies, the same challenges which conversely led to a -6% dip in shipments of high-end Industrial, machines priced above $100,000, and Midrange 3D printers, priced between $20,000–100,000, which were further impacted by high capital costs and interest rates.

Total additive manufacturing system revenues, however, grew by 5% year-on-year (YoY), and while the Industrial and Midrange sectors continued to face headwinds, a bounce back is expected as Industrial vendors report strong end-market engagement and interest, which they claim will come to fruition as business conditions improve - though likely not until 2026.

Chris Connery, VP of global analysis at CONTEXT, explained, “While the immediate forecast is challenging, there remains strong underlying pent-up demand, particularly for Industrial systems,’ says Connery. "OEMs still report high levels of customer interest, and the industry is poised to rebound once macroeconomic conditions improve. We expect a gradual recovery to begin in 2026 as interest rates fall and stimulate renewed capital spending, similar to the surge seen after the Covid lockdowns.”

Metals and polymer Industrial 3D printer shipments fell −14% YoY in Q1 2025. Even Chinese OEMs, which have fared more strongly than Western 3D printer manufacturers in recent quarters, were not exempt from the decrease, though they did continue to dominate the category. Metal machines performed better in this category - down just -8% compared to polymers' -18% - with large-format, multi-laser metals systems from Eplus3D and Nikon SLM Solutions continuing to lead the charge and prop up overall category figures with raised average selling prices.

It was a similar picture in the Midrange category as shipments dropped −16% YoY and Chinese vendors, led by Flashforge, performed better, mostly from domestic sales. UnionTech, for example, recorded a rise of 13% in this category, though it didn’t see the same success for its Industrial systems. Elsewhere, over the trailing-twelve-month period, established Western companies such as Stratasys, 3D Systems and Formlabs all saw drops in machine sales, contributing to a −13% drop in global shipments.

Shipments of Professional printers priced between $2,500–20,000 fell by -4%. FDM systems were most impacted here with a −31% drop in the period (and down −30% over the TTM) as buyers favoured lower cost machines from the likes of Bambu Lab, which launched new hardware this year. Formlabs, however, contributed significantly to the rise in shipments of vat photopolymerization machines which were up 19% YoY in Q1, with a 40% increase in shipments for its desktop stereolithography systems. New products from SprintRay are also said to have helped boost this segment.

Entry-level machines were the biggest success story for Q1 2025 with a 15% YoY increase. A huge 95% of that was attributed to Chinese vendors with Bambu Lab performing best with a 64% YoY increase in shipments. Creality also continued its leading position in the category, accounting for 39% market share, despite a -3% drop in sales.